Commercial Loans for the Refinance or Purchase of Healthcare Properties

The HUD 232 / 223(f) program provides mortgage insurance for the refinancing or acquisition of nursing homes, assisted living facilities, intermediate care facilities, or board and care homes. This attractive program offers a low fixed rate loan that is fully amortized with a maximum term of 35 years, or 75% of the remaining economic life. The loan is non-recourse, and assumable subject to HUD approval.

Find more information below or view our frequently asked questions about the HUD 232/223(f) loan and read more about navigating the loan application process with details and easy to navigate infographics.

Maximum Loan Amount for HUD 232 / 223(f):

- 80% of market value (85% for non-profits) for skilled nursing and independent living units.

- Amount that results in a debt service coverage ratio of 1.45x based on the underwritten net operating income.

- 100% of the transaction cost of a refinance, and 85% of the transaction cost for a purchase

Transaction Costs for a Purchase Include:

- Existing indebtedness of purchase price;

- Third party reports;

- Repairs;

- Initial replacement reserves; and

- Closing costs.

Check out this helpful infographic for frequently asked questions regarding a HUD 232/223(f) loan

Overview & Key Requirements of HUD 232 / 223(f) Loan

Eligible Borrowers

- Experienced for-profit and non-profit owners are eligible.

Eligible Facilities

Nursing homes, assisted living facilities, intermediate care facilities, and board and care homes that meet the following requirements:

- Must offer 3 meals per day;

- Continuous care;

- May include up to 25% non-licensed independent living units;

- Facility must be licensed by the state;

- Minimum number of 20 beds; and

- The facility must have been completed or substantially rehabilitated for at least three years prior to the date of application. If additions have been done in the last three years, the additions cannot be larger than the original project size and original number of beds.

Loan Term

- Up to a 35-year fixed rate, or 75% of the remaining economic life (fully amortizing loan).

Interest Rate

- Fixed, subject to market conditions.

Commercial Space

- 20% of net rental area and 20% of effective gross income.

Rate Lock Deposit

- 0.50% of mortgage amount collected at the time of client’s acceptance of the Firm Commitment. The rate lock deposit will be fully refunded at the transaction closing.

Prepayment

- 2-year lockout followed by 8 years of declining pre-pay of 8%, 7%, 6%, 5%, 4%, 3%, 2%, and 1% (other terms may be negotiated)

Assumable

- Fully assumable, subject to HUD approval. This feature makes the property very appealing to a buyer to assume a low rate in increasing rate environments.

Davis-Bacon Wage Rates

- Not applicable for this program.

HUD Fees for 232 / 223(f) Loan

The borrower is responsible for HUD fees.

_Loan.jpg)

Lender Ordered Third-Party Reports for HUD 232 / 223(f) Loan

The third-party reports listed are required prior to Firm Application submitted to HUD. They are all mortgageable, and can be reimbursed from loan proceeds at closing. The amount of the reports varies depending on the size and complexity of the project.

- Market Study

- Appraisal

- Phase I Environmental Assessment

- Phase II Environmental (if necessary)

Lender Fees for HUD 232 / 223(f) Loan

After the loan sizing, the processing fee (approximately $5,000 to $10,000) along with the required third-party reports are usually collected at the time of engagement with the lender.

Financing and Permanent Placement Fees

- Up to 3.5% of the final loan amount, and payable from mortgage proceeds at closing

The borrower is responsible for the lender financing, placement, and legal fees. These amounts vary based on the size and complexity of the transaction. These fees are paid out of the loan proceeds at closing.

Estimated Timeline for HUD 232 / 223(f) Loan

The timing to receive a Firm Commitment will depend on the LEAN underwriting queue, and how many deals that are currently being processed at the time.

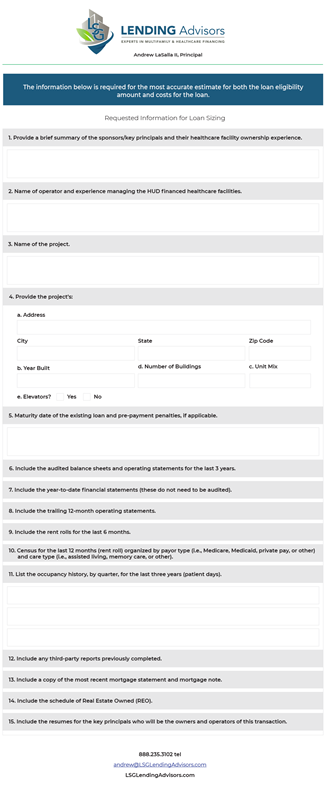

HUD 232 / 223(f) Basic Checklist for Loan Sizing

The information listed is required for the most accurate estimate for both the loan eligibility amount and costs for the loan.

Click on the image to download the checklist.

HUD 232 / 223(f) Term Sheet

Download the attached Term Sheet as a reference for eligibility, Interest Rates, Requirements, Limitations, Terms and more.